Gold’s London AM fix this morning was USD 1759.50, EUR 1,335.48, and GBP

1,110.66 per ounce.

Yesterday's AM fix was USD 1,747.50, EUR 1,326.68, and GBP 1,102.80 per

ounce.

Gold prices hit their highest since mid-November this morning as signals that

U.S. monetary policy will remain ultra loose increased investor appetite for

bullion.

Gold bullion has gained over 12% so far in 2012, and the ascent was

rejuvenated last week with Bernanke’s commitment to keep interest rates low and

money loose through 2014.

Spot gold hit a high of $1,762.90 before falling a few dollars to $1,757/oz

by midday in Europe.

Concerns about the jobs number later today is also supporting bullion.

Investors will be watching the US nonfarm payrolls report at 1300 GMT, after

yesterday's data showed a surprise drop in jobless claims for last week which

led to a pop in gold as did Bernanke’s testimony.

Spot palladium hit a 4 1/2 month high of $713.50. The metal used primarily

for producing autocatalyses for gas powered engines, is supported by US auto

sales which rose 11% this January, its best sales data in 2 1/2 years.

Gold Bullion Coin and Bar Demand Remains Robust – Tiny Vis-à-vis

Other Investments

Data internationally shows that demand for gold bullion bars and coins

remained robust in 2011 and into January 2012.

Demand is strong amongst the gold buying public but remains a fringe activity

of store of value buyers rather than a mainstream phenomenon. At this stage very

few retail investors have any allocation to gold whatsoever and very few have

even owned a gold coin or bar in their life.

This is slowly beginning to change with a small minority of retail investors

beginning to diversify into gold in order to protect against systemic risk in

the banking and financial sector (MF Global) and from the monetary risk of

currency debasement.

In Australia, the Perth Mint has reported very strong demand for gold and

silver coins in recent weeks. The mint is a major supplier of coins to the UK

and Europe.

Perth Mint’s sales director, Ron Currie told the Wall Street Journal that

gold coin sales during December and January are up around 80% compared with the

same months a year earlier, while silver coin sales have doubled. The mint’s

largest markets for coin demand include Germany and the U.S.

However, demand for gold bullion coins and bars remains tiny vis-à-vis

capital invested in stocks and bonds and vis-à-vis cash on deposit.

This suggests that the recent uptick in demand for gold coins and bars is

very sustainable – especially against the backdrop of the challenging

macroeconomic, systemic, monetary and geopolitical risk in the world today in

2012. A backdrop that is likely to be with us for the foreseeable future.

Sales of gold American Eagle coins this month total 114,500 troy ounces, the

highest volume in a year and the most since 133,500 in January 2011. This, in

turn, was the highest month since sales topped 150,000 ounces in May, June and

July of 2010.

Figures from the U.S. Mint show an 18% decline in gold American Eagle sales

in 2011 from the previous year, although sales of the silver Eagles still rose

15%.

Silver remains more affordable than gold and many bullion investors see

greater value in silver bullion. Some expect the gold silver ratio to continue

to fall with many believing, like GoldCore, that the gold silver ratio will fall

to 15:1 in the coming years.

American Eagles—the world's most popular minted bullion coins—are generally

viewed as a good indicator of retail investment demand for bullion –

particularly in the U.S.

Research: US Mint Gold Coin Sales for January - Signal Return to

Fundamental Driven Demand?

Dr. Constantin Gurdgiev, a non Executive member of the GoldCore

Investment Committee, has analysed the data of US Mint coin sales in January and

has looked at them in their important historical context going back to

1987.

January data from the US Mint on sales of gold coins presents an interesting

picture, both in terms of seasonality and overall demand for the asset

class.

Some background to start with. Gold prices have been moving sideways with

some relatively moderate volatility in recent months. Between August 2011 - the

monthly peak in US Dollar-quoted price and January 2012, price has fallen 4.55%,

but in the last month, monthly move was 10.82% and year on year prices are up

30.4%.

Crisis-period average price is now at USD1,154/oz and the standard deviation

in prices is around 337 against the historical (1987-present) standard deviation

of 330. In 2011 standard deviation for monthly prices stood at 144(small

sample-adjusted), well below historical volatility, due to a relatively

established trend through August 2011. However, prices returned to elevated

volatility in August 2011-January 2012.

These price dynamics would normally suggest rising caution and buyer demand

reductions over time. And to some extent, this sub-trend was traceable in the

data for US Mint sales in some recent months too.

For example, unadjusted for seasonal variation, August 2011 sales of Mint

coins peaked at 112,000 oz with relatively moderate 0.67 oz/coin sold gold

content. By November 2011, sales slowed down to a relative trickle of 41,000 oz

at 0.71 oz/coin sold. December sales came in at 65,000 oz with gold content on

average of 1 oz per coin sold.

Much media hullabaloo ensued with calls for catastrophic fall off in demand.

There were renewed claims that a gold bubble is now in action and the decline in

coinage sales is evidence of that.

In reality, there was very little surprising in the sales trends

overall.

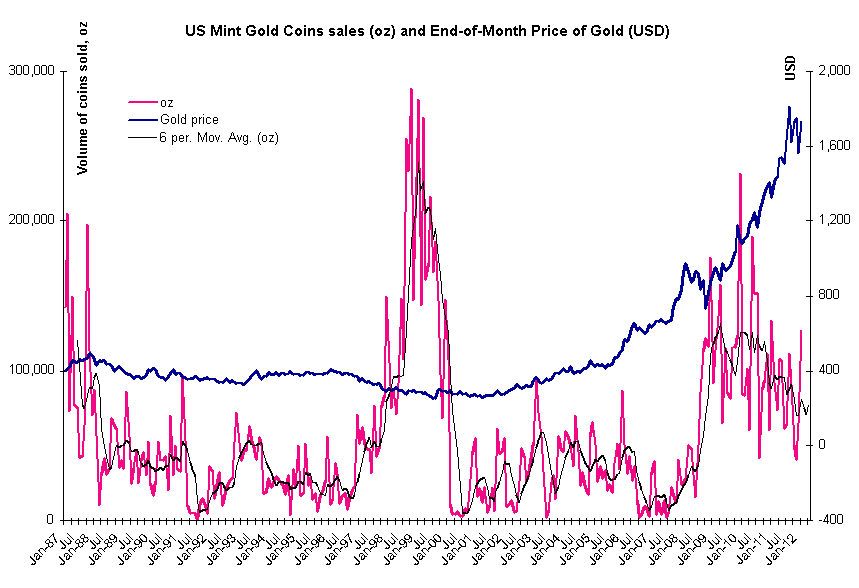

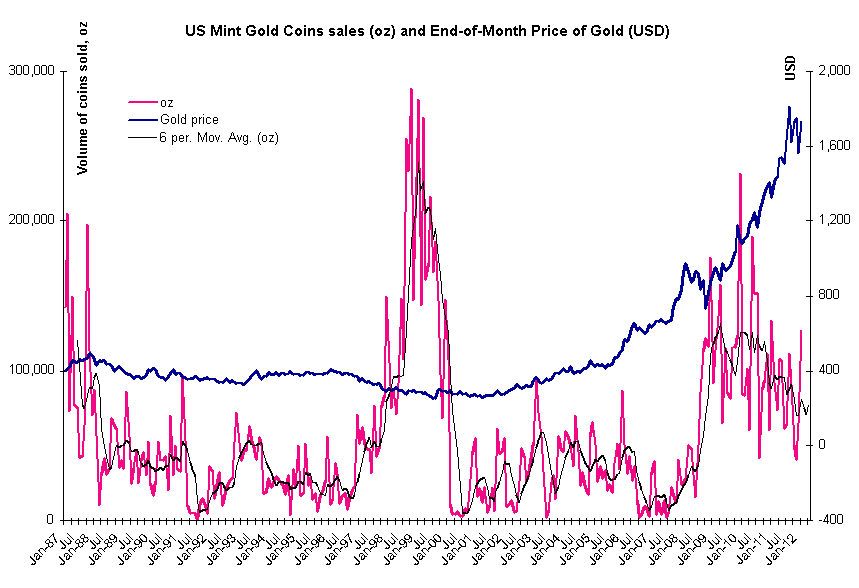

Chart 1 below shows US Mint sales in terms of the number of coins sold. Care

to spot any dramatic bubble-formation or bubble-deflation here? Not really.

There is a gentle historical upward trend since January 1987. There is

volatility around that trend in 2010 and far less of it in 2011. There is

seasonality around the trend with Q1 sales uplifts in January, some Christmas

season buying supports in early Q4 etc. There is also a slightly elevated

sub-trend starting from early 2009 and continuing through today. More

interestingly, the sub-trend is mean-reverting (heading down) which is -

dynamically-speaking stabilizing, rather than 'bubble-expanding' or

'bubble-deflating'.

Chart 1

Source: US Mint and author own

analysis

Source: US Mint and author own

analysis

Now, January sales are strong in the historical context and within the

sub-trend since 2009. January 2012 sales of US Mint coins came in at 127,000 oz

with relatively low 0.50 oz/coin sales. So coinage sales in terms of oz weight

are 95.4% up on December, but 4.9% down on January 2011. For comparison, 2011

average monthly sales were 83,292 and crisis-period average monthly sales were

94,745 all at least 0.5 standard deviations below January 2012 sales. As chart

above clearly shows, sales are now well ahead of historical averages and above 6

months moving average.

However, as chart below shows, sales in January were well below the trend

line for average coin weight for sold coins: oz per coin sold is down 50.5% mom

and down 43.1% year on year. Significantly, smaller coins were sold in January

this year than in 2011. 2011 average oz/coin sold was 1.0 and the latest sales

are closer to 0.59 oz/coin historical average.

Chart 2

Source: Author own data and analysis

based on underlying data from the US Mint

Source: Author own data and analysis

based on underlying data from the US Mint

There is no panic in the overall trends in demand for coins when set against

the price changes, with negative general trend in correlations between demand

and gold price established in mid-2009 continuing unabated, as shown in Chart

3

CHART 3

Source: US Mint, World Gold Council and

author own analysis

Source: US Mint, World Gold Council and

author own analysis

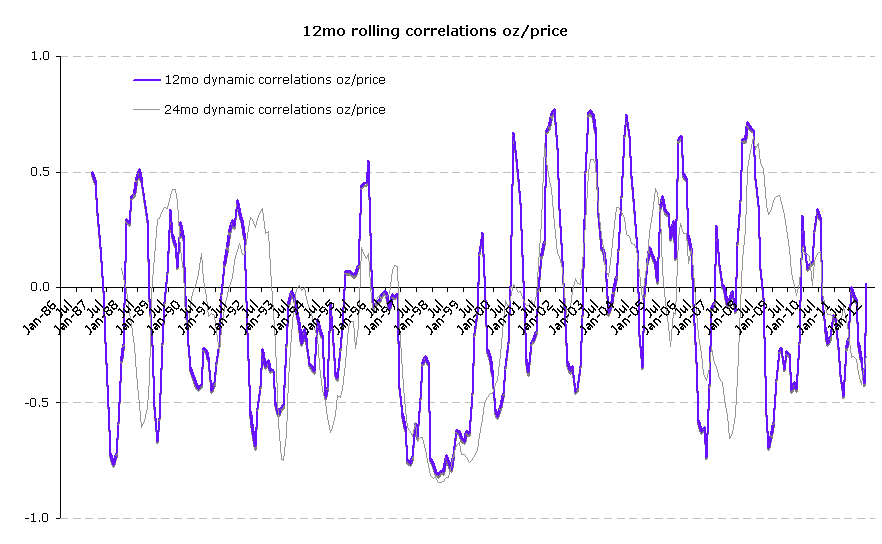

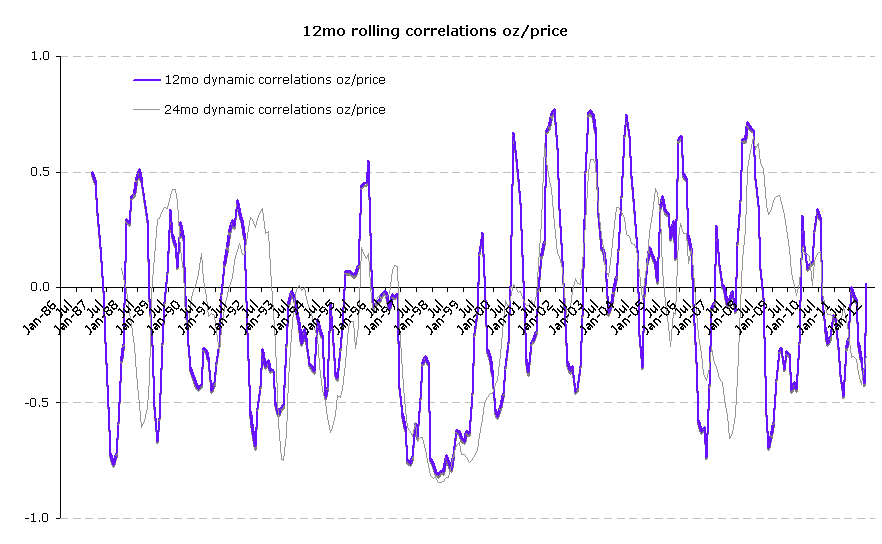

However, when we look closer at the 12 months rolling correlations and 24

months rolling correlations, the picture that emerges for January is consistent

with gentle negative correlation that has been present since the beginning of

2011. See Chart 4 below. January 2012 12mo rolling correlation between gold

price and volume of gold sold via US Mint coins is +0.02, having reverted to the

positive from -0.42 in December 2011. This is the first positive (albeit

extremely low) monthly 12mo rolling correlation reading since July 2010. 24 mo

rolling correlation in January 2012 stood at benign -0.30, slightly up on -0.34

in December 2012. Again, resilience if present in the longer term series and at

shorter horizon there are no huge surprises either. Of course, in general, one

can make a case, based on the recent data, that investors are simply turning

back to the specific instrument after gold price corrected sufficiently enough.

In this light, latest US Mint data would be consistent with

fundamentals-supported firming of demand. But crucially, there is no evidence of

either panic buying or selling.

CHART 4

Source: Author own analysis based on

the data from US Mint

Source: Author own analysis based on

the data from US Mint

Lastly, let's take a look at seasonally-neutral like-for-like January sales.

Chart below shows data for January sales, suppressing the huge spike at 1999.

Clearly, sales are booming in terms of coins numbers sold. But recall that coins

sold in January 2012 are smaller in gold content, so overall gold sold via US

Mint coinage is marginally down on January 2011, making January 2012 sales the

fourth highest on record.

CHART 5

Source: Author

own analysis based on the data from US Mint

Source: Author

own analysis based on the data from US Mint

The Table below shows summary of US Mint coins sales for 3 months

November-January covering holidays periods sales, including the Chinese New Year

sales. While January 2012 period shows healthy sales across all three

parameters, there is still no sign of any panic buying by small retail investors

anywhere in sight here. Sales are ticking nicely, in 2011 and 2012, well ahead

of 2001-2008 levels (confirming lack of perception in retail environment that

general sustained price appreciation is a signal to dampen demand), but behind

2009-2010 spikes (further confirming the view that 2011-2012 dynamics are those

of moderation in the precautionary and flight-to-safety motives for demand, and

more buying on long-term gold fundamentals).

Source: Author own analysis based on the data from US

Mint

Welcome back to ‘normalcy’ in US Mint sales.

Once again, the evidence above does not imply any definitive conclusions as

to whether gold is or is not a “bubble”. Instead, it points to one particular

aspect of demand for gold -- the behaviourally anchored, longer-term demand for

gold coins as wealth preservation tool for smaller retail investors.

It does suggest that there is little in the way of ‘animal spirits’ in the

gold market with no signs of a gold mania or ‘gold rush’ whatsoever.

Given the state of the US and other advanced economies around the world since

January, 2008, U.S. Mint data does not appear to support the view of a dramatic

over-buying of gold by the fabled speculatively crazed retail investors that

some media commentators are seeing nowadays.

The man and woman in the street in most western countries (except for

Germany, Austria and Switzerland) continues to be a more of a seller of gold

(jewellery into scrap) than a buyer of gold as seen in the western world

phenomenon that is ‘cash for gold